Fed Waits to Cut Rates

- Mortgage Returns

- Jul 30, 2025

- 2 min read

Overview: Although there was a significant amount of economic news over the past week, there were few market-moving surprises. In particular, the Federal Reserve meeting did little to alter the outlook for future monetary policy, and mortgage rates ended the week nearly unchanged.

As expected, the Fed did not change the federal funds rate on Wednesday, leaving it at a range between 4.25% to 4.5%, where it has been since December. However, the vote was divided, with nine officials in favor of holding steady and two officials supporting a rate cut. The meeting statement was similar to the prior one, emphasizing the high level of uncertainty about the economic outlook due to changes in government policies. Officials continue to wait to evaluate incoming economic data before changing monetary policy. Most investors expect that the Fed will reduce the federal funds rate by 25 basis points at the next meeting in September.

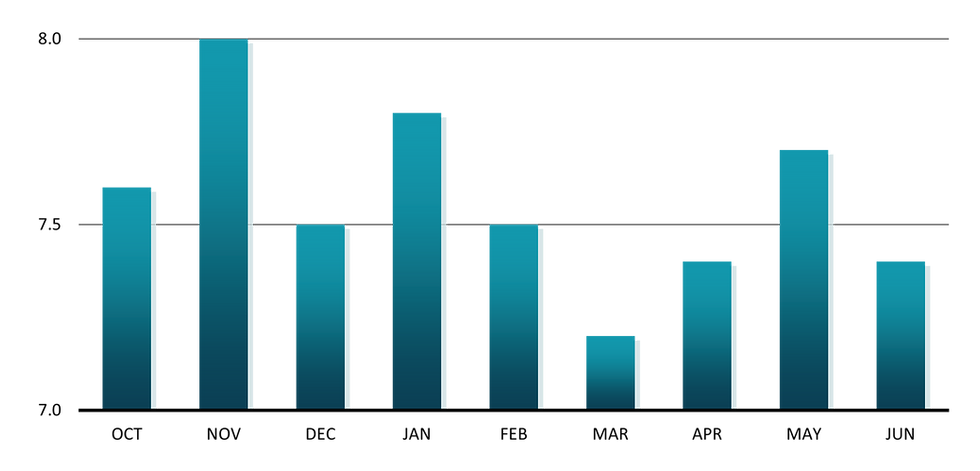

The latest Job Openings and Labor Turnover Survey (JOLTS) report, covering the month of June, revealed results that were close to expectations. At the end of June, there were 7.4 million job openings, down from 7.7 million in May. The ratio was about 1.1 openings for each available worker, down from a peak of over 2 in early 2022, and in line with the levels seen prior to the pandemic. A smaller number of openings suggests that companies face less pressure to raise wages to hire enough workers. Fed officials watch this report closely for hints about the tightness of the labor market.

Gross domestic product (GDP) is the broadest measure of economic activity. During the second quarter of 2025, U.S. GDP grew 3%, above the consensus forecast for an increase of 2.5%. This was up from a decrease of 0.5% during the first quarter, the first decline since the first quarter of 2022. The results were heavily influenced by a massive 30% decline in imports, following a 38% surge last quarter, as businesses and consumers raced to make purchases before higher tariffs kicked in.

Job Openings (millions)

Week Ahead

Jul. 31

Personal Income and Outlays

Personal Consumption Expenditures (PCE) Price Index

Aug.1

Institute for Supply Management (ISM) Manufacturing Index

Employment Report

Aug. 5

ISM Services Index

Comments