Home Sales Mixed

- May 24, 2023

- 2 min read

Overview: Over the past week, the attention of investors was divided among the debt ceiling talks, bank industry troubles, and comments from Federal Reserve officials. Although there was little significant fresh news in any of these areas, mortgage rates continued to climb higher.

The minutes from the May 3 Fed meeting, released on Wednesday, contained no significant surprises and provided no new guidance on the likelihood of additional federal funds rate increases. In fact, officials repeatedly emphasized the need to keep their options open due to the wide range of economic factors (debt ceiling talks, bank troubles, inflation) currently influencing financial markets. According to the minutes, banks will likely be more selective now, leading to fewer loans to businesses and consumers. This will slow economic activity and reduce future inflationary pressures. Officials generally want more time to see how this dynamic evolves before making their decision on whether to raise rates at the next meeting on June 14 or hold them steady.

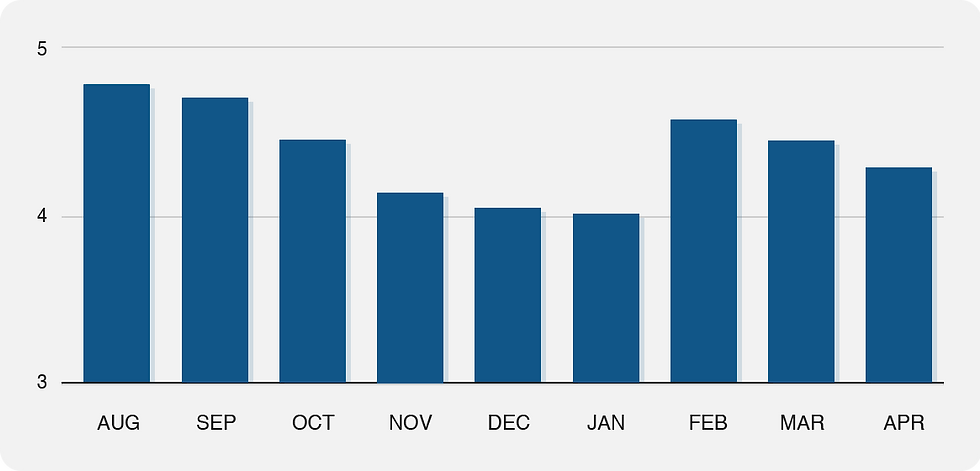

In housing news, higher mortgage rates and a low supply of homes on the market continue to negatively impact activity. Sales of existing homes, which typically make up about 90% of the market, fell 3% in April and were 23% lower than last year at this time. Inventory levels remain a big trouble spot, standing at just a 2.9-month supply nationally, far below the roughly 6-month supply that is generally seen in a balanced market. After reaching a record high of $413,800 in June, the median existing-home price is down to $388,800, which is 2% lower than last April.

New-home sales, which account for the remaining 10% of the market under normal market conditions, matched expectations in April with a small increase from March. While existing-home sales are based on closings, new-home sales reflect contracts signed during the month, meaning that new home sales are a better indicator of the most recent housing market activity. It’s also worth noting that roughly 33% of the homes listed for sale are new homes, far out of proportion to their usual much smaller share. This is another indication of the severe lack of existing homes available to buyers.

Existing-Home Sales (millions)

Week Ahead

Looking ahead, investors will continue to watch for progress in the debt ceiling talks, signs of problems in additional banks or other areas of the financial system, and comments from Fed officials on the outlook for future monetary policy. For economic reports, Personal Income and Outlays and the Personal Consumption Expenditures (PCE) Price Index, the inflation indicator favored by the Fed, will come out on May 26. Mortgage markets will close early that day and will be closed on Monday, May 29, in observance of Memorial Day. The next monthly Employment Report will be released on June 2.

Comments