Solid Labor Market

- Mortgage Returns

- Jul 9, 2025

- 2 min read

Overview: The major economic data released over the past week was a bit stronger than expected overall, particularly in the labor market and services sector. As a result, mortgage rates ended the week a little higher.

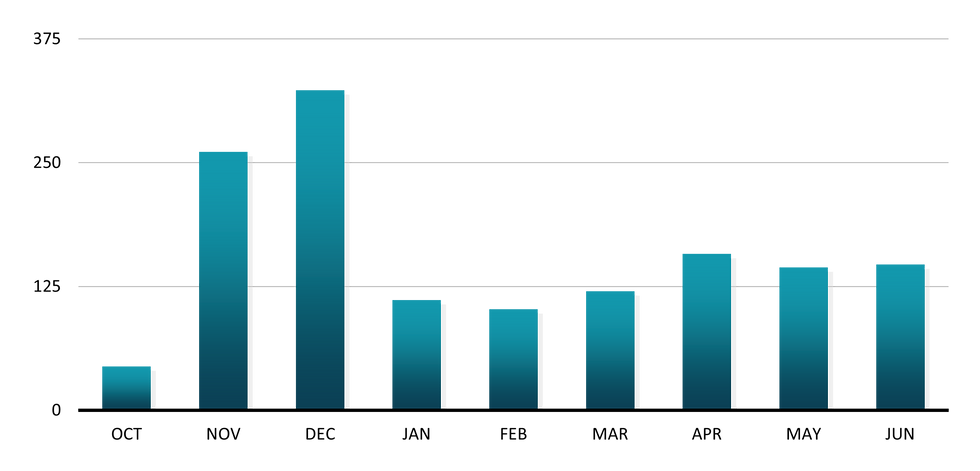

The highly anticipated monthly Total Nonfarm Payroll labor market report revealed that the economy added 147,000 jobs in June, above the consensus forecast of 110,000. Revisions to the results for prior months were relatively small. The government sector added a surprisingly large 73,000 jobs in June due to solid hiring at the state and local levels. Strength also was seen in the health care, social assistance, and construction sectors, while manufacturing lost jobs.

Looking at the other major components of the report, the unemployment rate unexpectedly dropped from 4.2% to 4.1%, the lowest level since February. However, the decline was mostly due to a decrease in people looking for jobs rather than growth in the number of people working. Average hourly earnings, an indicator of wage growth, were 3.7% higher than a year ago, down from an annual rate of increase of 3.9% last month.

Another significant economic report released this week by the Institute for Supply Management also exceeded expectations. The ISM Services Index increased to 50.8, a little above the consensus forecast. Readings above 50 indicate an expansion in the sector. Since services account for over three-quarters of U.S. economic activity, this is a positive sign for future economic growth. Given the strength of the latest labor market and services sector data, investors do not anticipate that the Federal Reserve will lower the federal funds rate at its next meeting on July 30.

Job Gains (thousands)

Week Ahead

July 15

Consumer Price Index (CPI)

July 16

Producer Price Index (PPI)

July 17

Retail Sales report

Comments