3 KPIs That Can Boost Your Bottom Line

- Aug 15, 2025

- 2 min read

Updated: Oct 21, 2025

You’re juggling listings, showings, and client calls, but are you tracking the numbers that matter most? If not, you might be overlooking a few crucial metrics that can make a big difference for your bottom line. Key Performance Indicators (KPIs) provide objective measures to help you see where your time and money are best spent. Keep your eyes on these three KPIs to gain clarity, improve your marketing, and close more deals with less guesswork.

This is the percentage of leads that convert to customers. It shows how effectively you’re turning customer interest into sales.

Sample formula:

Example: You got 50 online leads in a month and 2 became clients. Your conversion rate was 4%.

Why it matters: Instead of tracking one overall conversion rate, it’s important to track your conversion rate by lead source (e.g., online lead, referral, open house). This helps you identify which lead sources are most productive, enabling you to focus your time and budget where you’re most likely to see results.

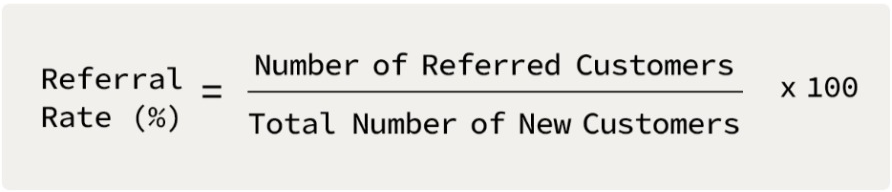

This is the measure of how many word-of-mouth referrals you’re receiving from existing or past customers. In a larger sense, it tells you how effectively you’re meeting customers’ needs and delivering excellent service.

Sample formula:

Example: Out of 10 new customers, 6 were referrals. Your referral rate was 60%.

Why it matters: Referrals are one of your most powerful sources of new business. In fact, 40% of buyers found their agent through a friend, neighbor, or relative in 2024.* By tracking this metric, you can gauge the strength of your client relationships and evolve your post-sale follow-up and engagement strategies.

This measures the profitability of marketing efforts by comparing revenue generated to dollars spent, and it can be applied to annual budgets, specific campaigns, or lead generation sources.

Sample formula:

Example: You spent $15,000 on direct mail last year, which generated $90,000 in new revenue. Your marketing ROI was 500%.

Why it matters: Marketing is an investment, and ROI helps you understand how effectively that investment is driving revenue. Tracking this KPI empowers you to allocate budgets wisely, cut underperforming campaigns, and scale high-ROI strategies.

As you can see, the math is simple, but the impact can be huge. With this data in hand, you’ll have the tools to make better decisions and build a more profitable, resilient business.

* National Association of Realtors (NAR)®, Profile of Home Buyers and Sellers 2024.

Comments